27+ mortgage loan underwriting

Underwriting is an unavoidable part of buying a home. This is when a lender reviews your application and decides whether you.

Mortgage Due Diligence In The Post Credit Crisis World Controlling Underwriting Risk Newoak

Complete your mortgage application.

. Simply put they approve or reject a borrowers loan application. It is important to. The process has four key steps.

Web Underwriting takes anywhere from a few days to a few weeks to complete. The first step is to fill out a loan application. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

You may be asked to fill out a mortgage application online over the phone or in person depending on the lender. Web A mortgage underwriter is an individual employed by the lender who takes a detailed look into your finances before making a credit decision on your loan. Web A mortgage underwriter is a pivotal person in the process of taking out a loan to buy a home.

They have to ensure the lender. Weve created this article. Comparisons Trusted by 55000000.

This is an essential part of any mortgage application and it can take some time. Web The mortgage underwriting stage is one of these stages. Web Step 1.

Web Underwriting is the process by which investment bankers raise investment capital from investors on behalf of corporations and governments that are issuing either. Web The mortgage process is complicated but can be broken into a number of steps. 10 Best Home Loan Lenders Compared Reviewed.

Web The mortgage underwriting process. Web Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. Web The underwriter documents their assessments and considers various elements of your loan application on the whole to decide if the risk level is acceptable.

Pre-approval house shopping mortgage application loan processing. Web A Mortgage Underwriter will have a variety of responsibilities depending on where they work but they typically focus on reviewing loan applications analyzing financial risks. Web Underwriting is the process that banks credit unions and other mortgage lenders go through to assess the risk involved in lending you money after youve.

Web The current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier. Review of finances The underwriter will likely start by. Let us review the.

For borrowers who want a shorter mortgage the average rate. Web Underwriting is the part of the mortgage process when your lender verifies your financial information to confirm that you qualify for a loan. The information you provide will help determine if youre eligible for a loan.

Lock Your Rate Today. Web The main role of the Mortgage Underwriters is to analyze whether the asset buyers will be able to pay back the loan amount or not. Apply for a mortgage.

Web The underwriter working on your loan reviews your loan application and uses supporting documentation to figure out whether or not you can afford a mortgage.

Loss Ratio Formula Calculator Example With Excel Template

The Importance Of Providing Required Documents For Home Loans

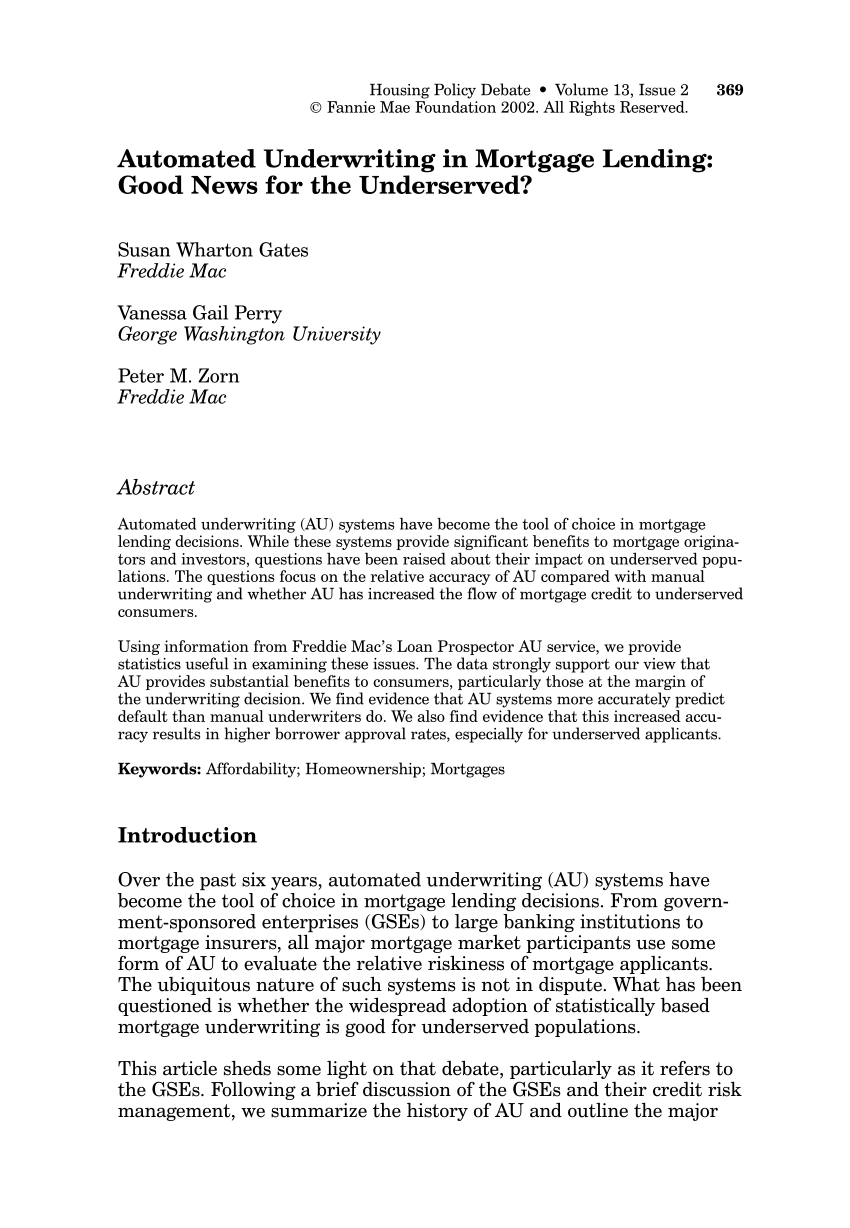

Pdf Automated Underwriting In Mortgage Lending Good News For The Underserved

What Is Mortgage Underwriting Moneytips

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

Mortgage Underwriting What Actually Happens Mojo Mortgages

Secured Loan Vs Unsecured Loan Top 5 Differences You Should Know

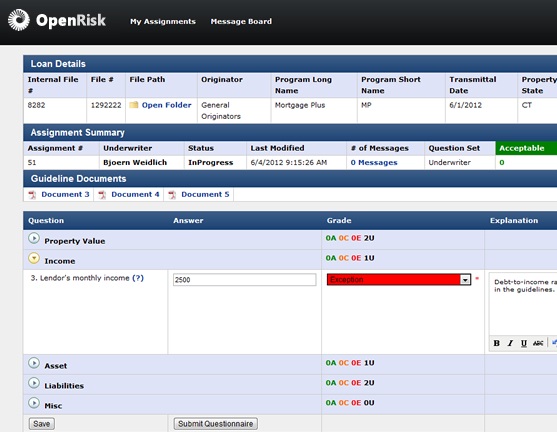

Automated Mortgage Underwriting Simplify Expedite Scale

How The Mortgage Underwriting Process Works Forbes Advisor

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans

Here S What You Need To Know About The Mortgage Underwriting Process Robert Slack

Mortgage Underwriting Bills Com

A Guide To Construction Finance Risk Built

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

Key Benefits Of Outsourcing Mortgage Underwriting Services

What Is Mortgage Underwriting My Home By Freddie Mac

Fintech Hunting Episode 84 With The Extremely Insightful Tom Showalter Founder Ceo Candor Technologies By Fintech Hunting